In a world of increasing data volume, managing spreadsheets and numbers is becoming more and more complex. Today’s finance organization needs a new set of tools to keep up with this fast-paced development. Enter AI technology.

In this blog post, we present insights taken from Gartner’s webinar on the AI-Forward Finance Organization while exploring more on how WIZ.AI can help with AI adoption in your financial organization.

Overload of financial data

Analysts predict that data volume will double to 181 zettabytes by 2025, which is a staggering amount. But what makes going through the world’s trove of digital data more challenging is its complexity, rather than its volume. Gartner foresees that data complexity will increase 4x in three years, twice the increase in volume. At the end of the day, it’s not just how much data we will get – it’s how much harder it will be to make sense of it all.

Many organizations today rely on spreadsheets for its operations, including financial functions. While these tools were powerful in their time, spreadsheets – even macro-enabled ones – are continuously being strained by high data volumes and complex data interconnectivities. It’s not uncommon to find broken links within spreadsheet models, or calculations that fail to present expected results due to technological limitations. The increase in data volume and complexity needs a smarter, more flexible solution.

Artificial Intelligence in finance

The rise of artificial intelligence (AI) in recent years has led to solutions that answer the data accessibility and navigability question. Enterprises are recognizing the power of AI and as of 2022, 59% of organizations surveyed by Gartner Research have started an AI initiative or adopted AI into their processes. And while this is a promising sign, it also speaks of risk to AI laggards. Businesses that fail to embrace AI technology to streamline processes will fall behind even faster in today’s accelerated market.

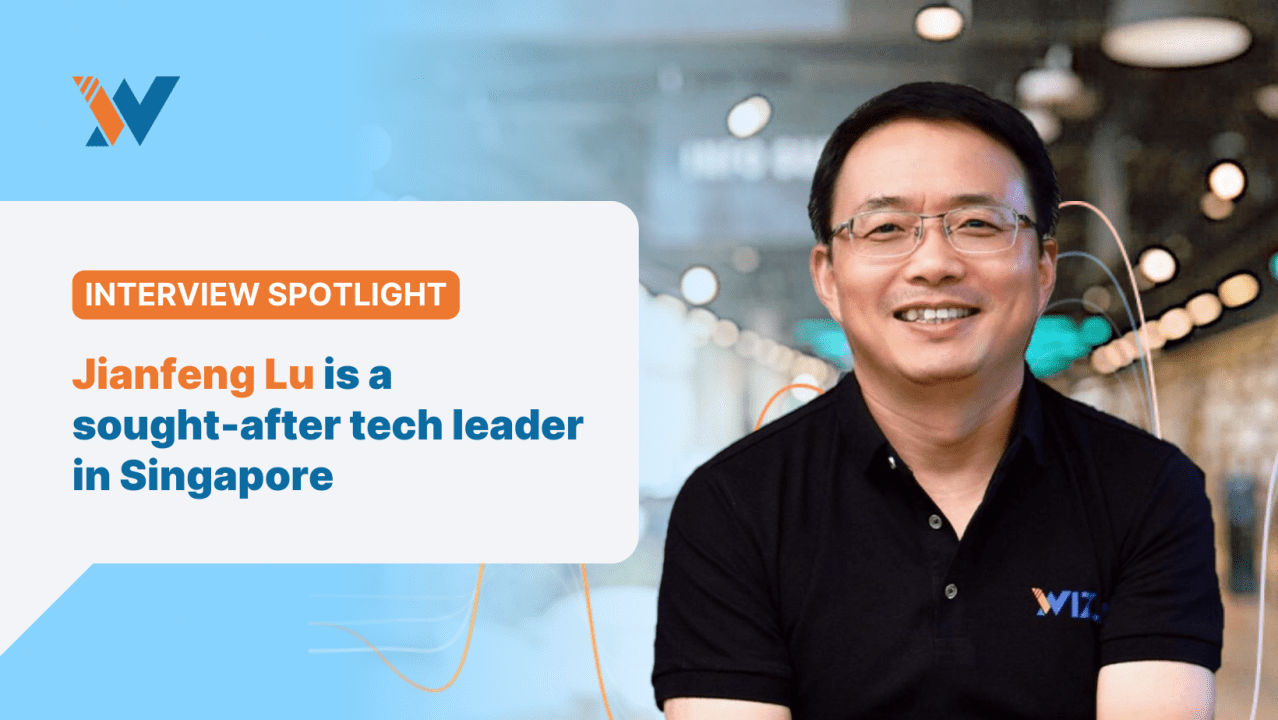

To embark on an AI journey, the key thing is to embrace change – to think differently and learn new things.

Increasing Bank Competitiveness with Generative AI

Explore the Future of Banking with Generative AI. Download this whitepaper and explore:

– Technological and Generative AI trends in banking operations

– Challenges faced by the industry in adopting new technology

– Real-world applications and results with WIZ.AI solutions

Here are the different steps that your financial organization can adopt to kickstart your AI journey:

1. Start top-down – digital transformation, especially for finance-related activities, gets stronger buy-in when top management initiates the change

2. Understand that AI deployment is non-linear – adopt an agile working mindset and be willing to have more cyclical deployment patterns

3. Be open to experimentation – most organizations adopting AI take five iterations to get right things right or succeed

Pitching AI Adoption in Finance: A Practical Guide

Position it as a proof-of-concept exercise where further adoption is dependent on results gained. Taking a packaged solution is one of the most frictionless ways for finance companies to dip their feet into the AI pond. For organizations that require debt collection or payment reminders, WIZ Talkbots are an easy way to introduce AI technology and quickly reap the benefits of AI-powered automation. Learn more about AI and debt collection from our blog on How AI can Boost Results in Debt Collection.

Some of the pushback when it comes to AI stems from the fear of losing jobs. To overcome this, AI advocates should find ways where AI will complement human efforts. Best examples are process automations where humans are still needed for exception handling or complex cases. Remember, Humans are great at strategy and handling exceptions to rules, as well as seeing the big picture and drawing insights. Machines or AI are great at calculating, analyzing, executing processes, sending warnings at critical points, and enforcing rules or guidelines. Find the right balance between human and machine, and communicate how AI can empower humans to do more in less time or with less cost. Find out more about human-AI collaboration from our blog on Why should Leaders Aspire for Collaborative Intelligence.

Whether you’re a cutting-edge fintech or a well-established traditional financial organization, AI solutions should be in your future-proofing arsenal. Adopting a pre-built solution is one of the easiest ways to get started on your AI journey. A recent report from Gartner states that 30% of businesses with advanced AI adoption have seen better results than expected.

How can WIZ.AI Help with AI Adoption for Your Financial Organization?

Customer interactions are an excellent source that can facilitate insights into customer behavior patterns. A large amount of these customer data often go untapped and not analyzed due to its volume, complexity, and the unavailability of the right solution to handle these pieces of information. However, integrating WIZ.AI’s AI-powered intelligent solutions into your financial institution can help with analyzing customer data efficiently and provide you with customer behavior insights that can be used for improving customer engagement. These insights would be highly beneficial in updating key conversation scripts that are used by WIZ.AI’s Talkbots. Furthermore, WIZ.AI’s AI solutions can benefit your financial organization in several other ways, such as:

- Aid with cross-selling campaigns and improve conversion rates

- Increase credit collection by 2.5 times

- Ensure operational scalability and adaptability

- Provide adherence to safety and compliance regulations